What is SWIFT System and How It Works

SWIFT is a messaging network that financial institutions use to securely transmit information and instructions through a standardized system of codes. Society for Worldwide Interbank Financial Telecommunications (SWIFT) is member-owned cooperative that provides safe and secure financial transactions for its members.

How does SWIFT work?

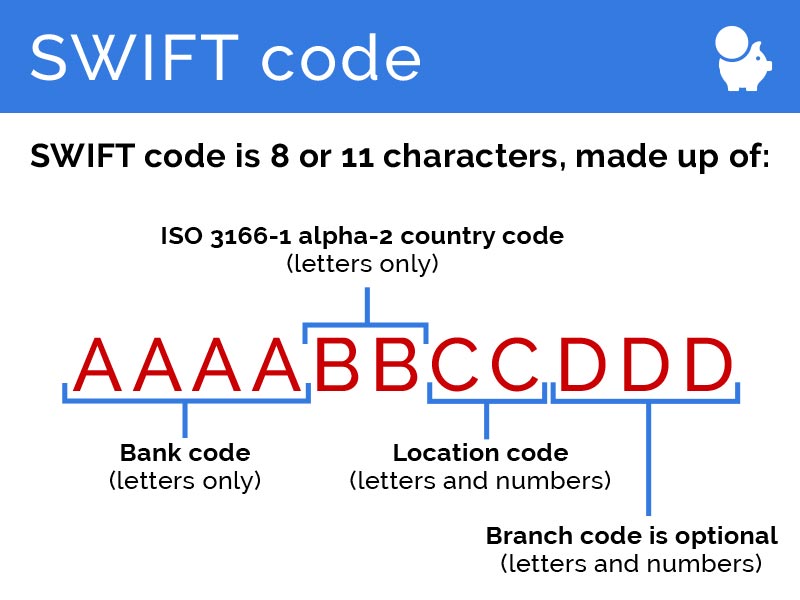

SWIFT works by assigning each member institution a unique ID code that identifies not only the bank name but country, city, and branch. SWIFT assigns each financial organization a unique code that has either 8 or 11 characters.

Why is SWIFT code system needed/useful?

The core of SWIFT business resides in providing a secure, reliable, and scalable network for the smooth movement of messages. Through its various messaging hubs, software, and network connections, SWIFT offers multiple products and services which enable its end clients to send and receive transactional messages. As powerful as SWIFT is, keep in mind that it is only a messaging system – SWIFT does not hold any funds or securities, nor does it manage client accounts.

Before SWIFT existed there was Telex

Prior to SWIFT, Telex was the only available means of message confirmation for international funds transfer. Telex was hampered by low speed, security concerns, and a free message format–in other words, Telex did not have a unified system of codes like SWIFT to name banks and describe transactions. Telex senders had to describe every transaction in sentences which were then interpreted and executed by the receiver.

Who does SWIFT provide services too?

SWIFT provides services to the following organizations:

- Banks

- Brokerage Institutes and Trading Houses

- Securities Dealers

- Asset Management Companies

- Clearing Houses

- Depositories

- Exchanges

- Corporate Business Houses

- Treasury Market Participants and Service Providers

- Foreign Exchange and Money Brokers

SWIFT stands behind almost every international money and security transfer. It’s very reliable and secure.

An example of how SWIFT works

Assume a customer of a Wells Fargo branch in San Francisco wants to send money to his friend who banks at the Barclays branch in London.

The San Francisco customer can walk into his Wells Fargo branch with his friend’s account number and Barclays unique SWIFT code for its London branch. Wells Fargo will send a payment transfer SWIFT message to the Barclays branch over the secure SWIFT network.

Once Barclays receives the SWIFT message about the incoming payment, it will clear and credit the money to the UK friend’s account.

ABC offshore

ABC offshore